A normal expert may be forgiven for presuming that affordable housing is no problem in the Gulf Region, with its rapidly expanding economies and high national incomes … but, as everywhere else in the world, affordable housing is a continuing need.

The better the society, the stronger its economy and the faster its growth, the more it will need a conscious policy to create and preserve affordable housing, and well-targeted resources to assure delivery of both homes and loans. Nowhere is this more apparent than in the Gulf.

Affordable housing is an essential delivery for the Gulf Region to succeed long-term

Every nation in the world either has already urbanized or is rapidly urbanizing– and as people urbanize, housing moves from being a

physical good to a

money good – that is, something people have to pay for rather than manufacture themselves. Once this happens, its delivery requires finance, both for the eventual consumer/ occupant/ homeowner and for the development process.

In fact, housing affordability is a retreating rainbow: the price of urban housing rises with the price of urban land, and that rises with the potential earning power of the people who sit atop that land, either in homes or in offices, factories, and shops. As the city becomes larger and richer, housing becomes more costly, and though the bottom quartile becomes less poor in absolute terms, market housing remains just out of reach.

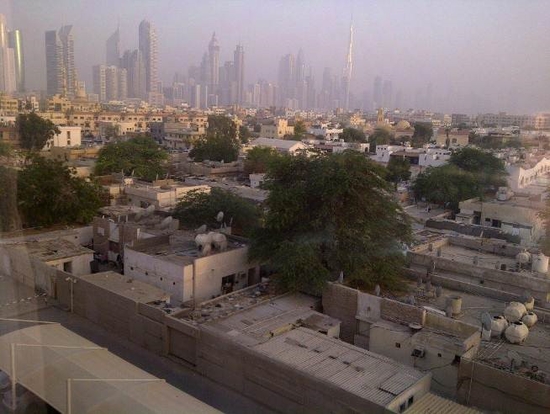

In the quest for density, urbanization sends buildings upward, and that drives up land values. As office towers reach into the desert sky (as in Dubai, photo above), they create jobs, and those jobs need somewhere to live. The land-value economic pressure increases occupancy density of existing properties, and creates slow informalization, where larger single-family dwellings become quietly subdivided into apartments and dormitories.

Dubai, 2012: New jobs rise into the haze, and existing housing informalizes under our noses.

As suggested by Rakesh Mohan, Deputy Governor of the Reserve Bank of India, future national competitiveness and economic success will depend on the comparative efficiency of cities; if so, because housing is where jobs go to sleep at night, then the quantity, quality, availability and affordability of housing becomes a component in national economic competitiveness.

Affordable housing is essential urban infrastructure. It is what makes successful cities scalable, and scalable cities successful. Its importance was underscored just last week, at Ernst & Young's Doha, Qatar

Growing Beyond 2012 300-person summit, where the agenda led off with a panel on affordable housing, at which I was one of three speakers.

Affordable housing is a nation's most challenging public-policy intervention

As a nation's cities become engines of wealth generation, housing cost rises even as the definition of 'market quality' is likewise rising. Thus quality affordable housing costs more to create than its economic value when occupied by the people for whom it was created. Because of this, below-market-income people can never afford market-quality housing, and affordable housing must always be a national imperative.

Around the world, nations that have moved into government involvement with housing affordability never exit the space. Over the decades, their involvement deepens and diversifies, with an increasing number of programs, financial products, subsidies, and government-based housing-related entities. This involvement also becomes more complicated because housing is challenging:

- It is both abstract (finance) and tangible (physical homes).

- It touches everyone, because everyone lives in housing.

- It affects household composition and growth.

- Success is measured in decades; mistakes last even longer.

- The scale is enormous.

Additionally, production and financing of housing are each the outputs of immensely complicated value and supply chains, both of which are heavily intertwined with government policies.

- Supply side. Production entails land assembly; zoning and permitting; trunk infrastructure; site infrastructure; configuration and layout; design; and construction.

- Demand side. Financing entails origination; income or eligibility qualification; application and verification; underwriting and loan credit; closing and recordation; structure of the financial product; loan placement and liquidity (including secondary markets or liquidity facilities); loan servicing; and enforcement.

The Gulf Region has distinctive, even unique characteristics

Though every market or situation in time is distinctive, the Gulf Region is especially so:

- Rapid urbanization dependent on technology. Many cities' climates are benign enough to tolerate self-built shanty towns and informal settlement. Gulf Region countries, by contrast, have water shortages and extreme heat. Gulf Region urbanization depends on technology and infrastructure, and that means growth involves government much more directly than elsewhere.

- Recent urbanization. Many Gulf cities have grown in only the last few decades. They have yet to confront the need for redevelopment or regeneration – but they will.

- High percentages of expatriate workers and residents. Expatriates are 67% of the Kuwaiti population, 80% of Saudi Arabia's workforce, and over 90% of Dubai's. Even if national housing policies limit their principal customers solely to citizens, every person seeking housing in a country influences the price and availability of all housing for all customer groups. Interconnectedness is inescapable.

- Multi-tiered residential markets segregated by law, configuration, and location. Several Gulf Region housing markets are parallel worlds: one for citizens, one for affluent expatriates, and one for laborers. Each has its own preferred locations, configuration and layout, and tenure models, all of which can be self-reinforced through laws (such as limits on foreigners owning real estate), customs and expectations.

- Islamic financing and land use/ occupancy. Sharia-compliant financing (ijara, murabaha, and musharaka loan vehicles) and land use patterns (including waqf) are evolving at different paces within the Gulf Region.

The way forward requires innovation

Throughout history, cities have been the only sustainable engines of ideas, innovation, and wealth creation. In turn, cities require housing and affordable housing in large enough quantity, quality, and availability to enable the city to accommodate the new workers who come with the new jobs that a growing economy creates.

The future's successful cities will be inclusive cities. Inclusive cities need effective affordable housing. For the Gulf Region, this is a clarion call to innovation in both the private and public sectors.